Paysend is the money transfer service internationally, which is regulated through the financial conduct authority based in the UK, and its headquarters is settled in London. Globally, paysend is among the primary money transfer services which operate in most of the continents. Debt is seen to be a growing technological money site that puts its primary focus on the money transfer under the next and following generational stages. The system enables customers to gain more when they send their cash across many countries as well as the territories. It also offers low fixed fees, PCI DSS certification, simple methods of transfer, and instant online money transfer processing.

Paysend is the money transfer service internationally, which is regulated through the financial conduct authority based in the UK, and its headquarters is settled in London. Globally, paysend is among the primary money transfer services which operate in most of the continents. Debt is seen to be a growing technological money site that puts its primary focus on the money transfer under the next and following generational stages. The system enables customers to gain more when they send their cash across many countries as well as the territories. It also offers low fixed fees, PCI DSS certification, simple methods of transfer, and instant online money transfer processing.

Alternatives: Best Money Transfer Services

Wise

First Transfer Free!

- Wise is a very good provider for overseas transfers. The transfers are easy, convenient and secure. The most important thing is that the transfers are also much cheaper than with the bank.

transferGo

Send money very fast!

- Save up to 90% compared to banks. No hidden costs. Large selection of countries.

currencyfair

Five Transfers Free!

- A world-class customer service, very good exchange rates and permanently favorable transfers abroad and to Germany convince. Only downside is the small selection of countries.

Definition of Paysend Review

Paysend is the online and automatic money transfer system that is globally used to ease and fasten the growth and development of businesses. The system has its main offices located around CIS, UK, and Asia, making it spot powerful presence globally. paysend is known to have linked with several providers of debt s so that it can ease the transfer of money process. The online method of money transfer from the paysend system can begin from as low as 1 pound, 2 pound, or even 1.5 pound. The system serves more than 1.4 million customers, and also their services are available and accessible throughout days and nights. When looking for reputable companies basing on money transfer paysend among them, and when customers use it, they will gain many benefits than expected.

What to do with Paysend

It enables all the registered customers to be in a position to send money to other foreign countries. The system also demands a minimal fixed rate provided you have a card number and the party name. It has partnered with other external money transfer systems making it hassle-free, simple, and also seamless. For you to successfully transfer money through paysend, you should first complete registration where you provide a valid telephone number and a secure password, which is alpha-numeric in both cases.

You should also provide valid personal details like date of birth, name, surname, postcode, email, address, country, and the city. After the provided details have been proved to be accurate, you can now submit them where the system sends you a registration code through your mobile number that has been used for registration. After the details are verified, the account will become active hence ready to perform money transfer.

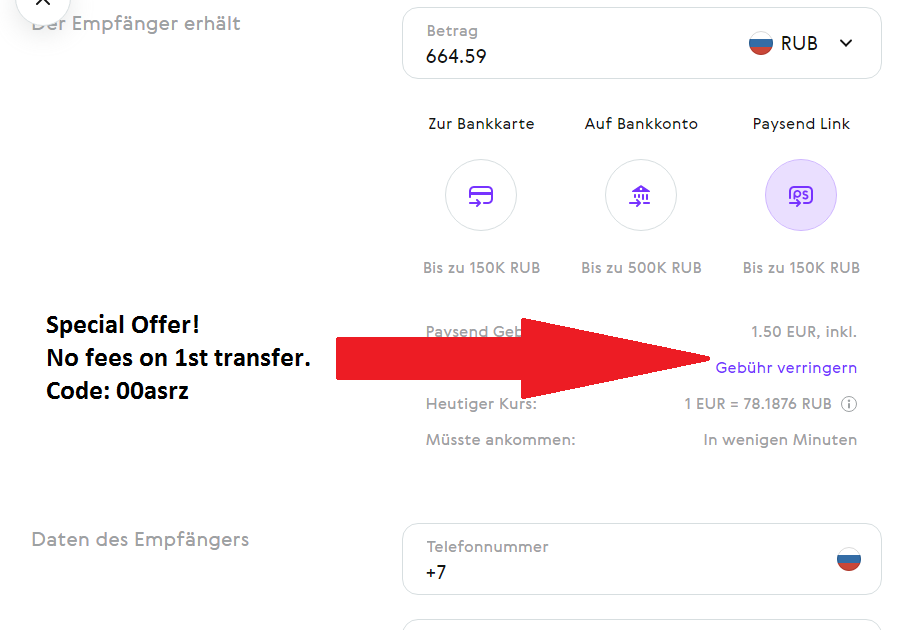

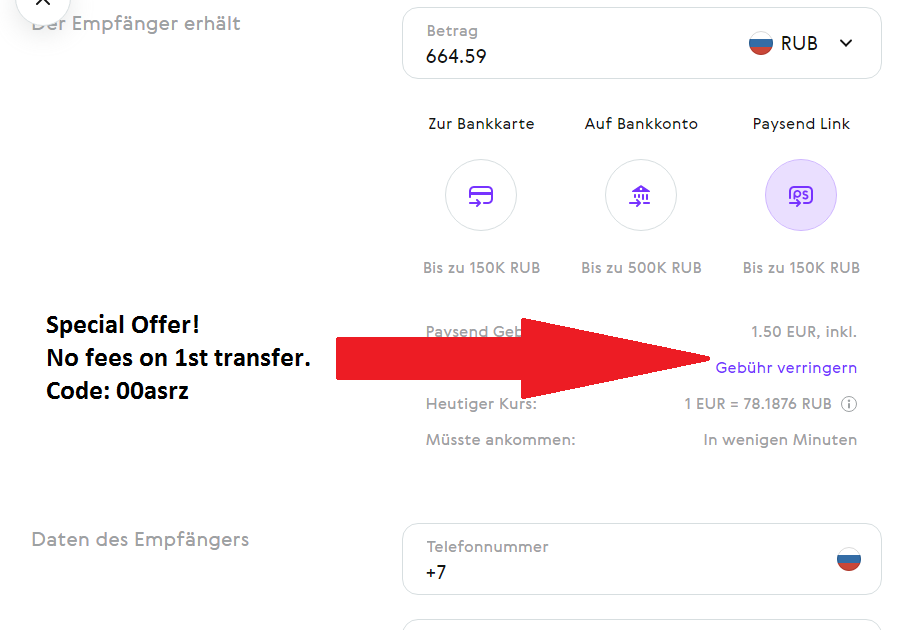

The system makes an easy transaction process since every method of processing has a limited transfer, which might be increased according to the paysend approval. After entering the amount that you want to send to your recipient, together with its receiving currency, the exchange rate, fees per transaction, with delivery listed time, will be seen. There, you can provide the details of your money recipient onto the empty block. Such information can be card information, card number, house number, street, the city, and the input of your recipient.

Cost of using Paysend

Speed of money transfer with Paysend

The Paysend system is regarded to be so popular since its speed for transferring money happens to be in terms of average rates for other money transfer systems. The system is partnered with several other methods of transferring money, making it easier and faster for the senders and recipients to get and send money instantly. It also has some sophisticated paysend processing, which makes sure the transactions are all tracked easily, making the customers monitor all the information going on with the way their money transfer is moving. The senders experience a debit of funds from their cards after clicking the send button, and recipients get a credit of funds in their accounts after that. If transactions are among different faraway countries, it can take to three working days for them to fully receive the funds.

Reliability and aafety of using Paysend

Paysend is regarded to be the most regulated money transfer through the online method about reliability and security. The systems boast a financial conduct authority license, which is based in the UK. The account informational integrity is also safeguarded throughout, which is in terms of level 1 of PCI DSS compliance. Several security measures include 3D secure protection, anti-fraud protocols, together with card verification protocols. There are extra security benefits that ensure the integrity, safety, and reliability of all the paysend transactions.

Why should you use Paysend

Among the many available and reputable methods of transferring money, paysend is still recognized to be among the best due to some reasons, which are explained below.

The transfer of money internationally through paysend is cheaper. It costs very less regardless of the money which you need to send. The paysend system interacts with very competitive mid-markets, which hence guarantee the best money value.

Most parts of the experience trans processing. Here is where the sender has its cards immediately debited and after that credited on the recipients card. It can only go for three business days if the concerned parties are too far.

It is known to offer very responsive customer care services where it also has many contact alternatives among which chat functionality, FAQS, Instagram, Facebook, Social media pages, LinkedIn, and YouTube are all available. The platforms have representatives who are always are to chatting back and help you whenever you need their help.

Bottom line

Paysend has so far qualified to be among the most transfer services of money internationally throughout the markets. The process signifies inception all through to the delivery point. Provided you give faster and secure registration as a sender of funds, you thoroughly verify your request to transfer money, and then submit your entire paysend, and then you qualify to send cash through paysend. All foreign country recipients are identified using their names, account numbers, and also the addresses given by the senders.

Best Money Transfer Send Money Worldwide

Best Money Transfer Send Money Worldwide